In a notable development within the fintech sector, personal finance startup Monarch Money has successfully raised $75 million in a Series B funding round. This investment, co-led by FPV Ventures and Forerunner Ventures, elevates the San Francisco-based company’s valuation to approximately $850 million.

Capitalizing on Market Shifts

Monarch’s funding achievement is particularly significant given the current challenging environment for fintech startups, often referred to as a “nuclear winter” due to decreased investor enthusiasm and reduced venture capital activity. The company’s growth trajectory was notably influenced by the discontinuation of Intuit’s Mint in early 2024, which led to a substantial increase in Monarch’s user base as consumers sought alternative personal finance tools

A Comprehensive Financial Management Platform

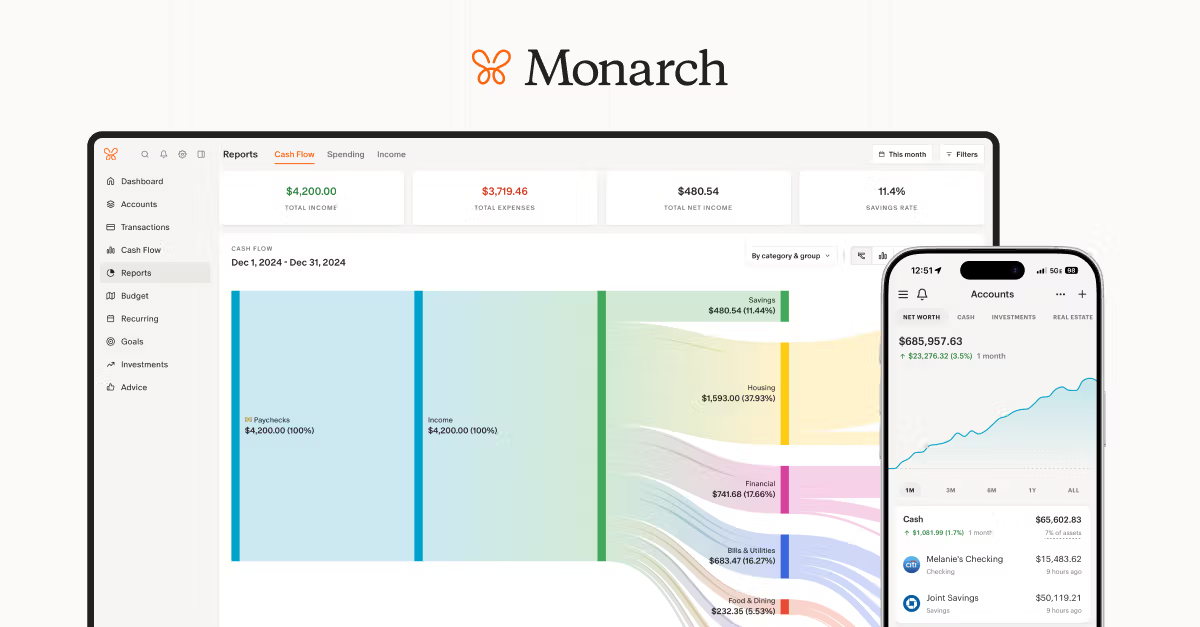

Founded in 2018 by Val Agostino, a former product manager at Mint, Monarch offers an all-in-one platform designed to assist users in managing their finances effectively. The app provides features such as budgeting, investment tracking, and financial goal setting, all within a user-friendly interface. Unlike some competitors, Monarch operates on a subscription-based model, eschewing advertising and data sales to prioritize user privacy and experience

Strategic Use of Funds

The newly acquired capital is earmarked for several strategic initiatives, including accelerating subscriber growth, expanding the company’s team, and enhancing the platform’s features. Plans include the development of new tools for financial planning, deeper integration with various financial institutions, and the incorporation of AI-driven insights to provide personalized financial advice

Investor Confidence and Industry Impact

The successful funding round underscores investor confidence in Monarch’s approach to personal finance management. Wesley Chan, co-founder of FPV Ventures, likened Monarch’s potential impact on the fintech industry to that of Canva in the design space, highlighting the app’s intuitive design and user-centric features.

Looking Ahead

With this infusion of capital, Monarch is well-positioned to further its mission of democratizing financial wellness. The company aims to continue innovating in the personal finance space, providing tools that empower users to take control of their financial futures. As the fintech landscape evolves, Monarch’s commitment to user privacy, comprehensive financial management, and intuitive design sets it apart as a leader in the industry.