Driving financial inclusion in Africa’s major tech ecosystems has become a key focus for governments, particularly in regions where cash remains the primary payment method. These governments have launched various initiatives to increase the number of individuals with access to banking services. In Egypt, platforms like Fawry and InstaPay have leveraged the central bank’s policies aimed at reducing cash dependency. As a result, e-wallets and cards have gained popularity in the North African country, with 64% of Egyptians adopting digital payment solutions last year. According to a Mastercard report, the number of mobile phone wallets has reached 46,500 per 100,000 people.

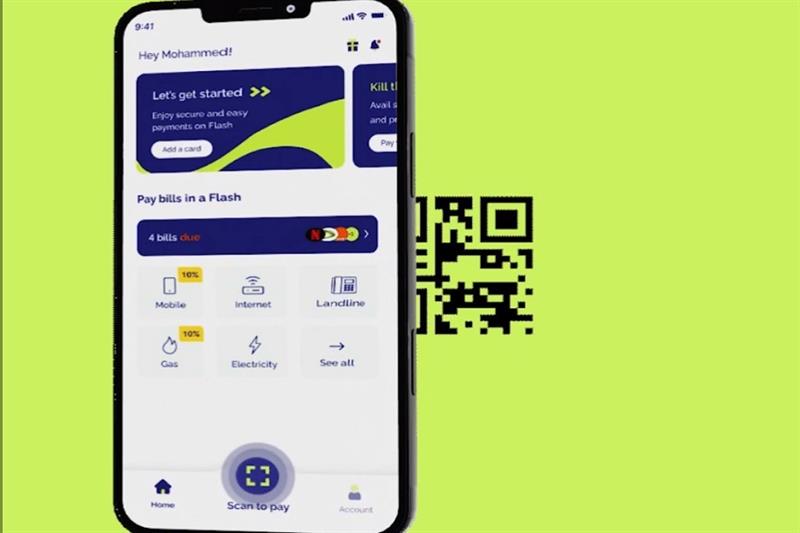

Although e-wallets and cards dominate the digital payment landscape, the Central Bank of Egypt is eager to promote an alternative method: contactless payments. Recently, the bank issued regulations governing payment card tokenization on mobile apps. However, services like Apple Pay, Google Pay, and Samsung Pay, which enable customers to make contactless payments using digital cards stored in mobile wallets through NFC (near-field communication) technology, are largely absent in Africa. In light of this, platforms such as Flash offer an alternative solution through QR codes.

Flash, an Egyptian fintech company, has recently secured $6 million in seed funding, led by Addition. This funding round will support the company in advancing the fintech industry in Egypt. By utilizing QR codes, Flash enables users to make contactless payments, bridging the gap left by the absence of major mobile payment platforms in the region. With this investment, Flash aims to further expand its services and contribute to the ongoing efforts to drive financial inclusion in Egypt.

The adoption of digital payment solutions in Egypt has witnessed significant growth, and Flash’s innovative approach aligns with the government’s objectives of reducing cash dependency and promoting financial inclusion. As the fintech industry continues to evolve in Africa, initiatives like Flash play a crucial role in facilitating secure and convenient digital transactions, ultimately driving economic growth and empowering individuals across the country.